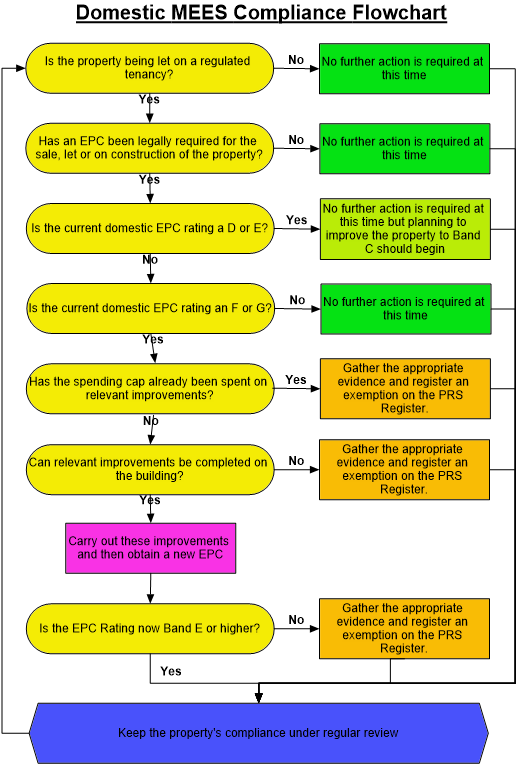

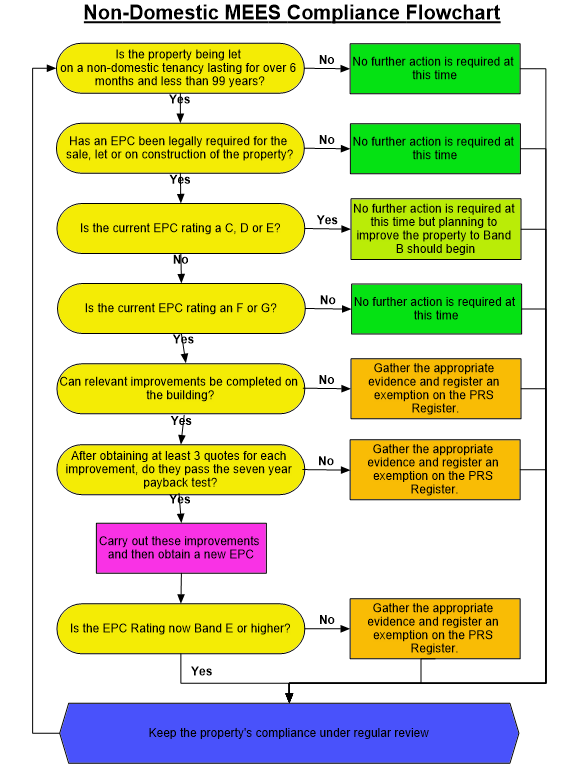

The Minimum Energy Efficiency Standards (MEES) were established by the The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015. They apply to all qualifying privately rented properties. There are different regulations for both domestic and non-domestic properties but, in essence, a building must currently have an EPC rating of Band E or above to be rented out unless a necessary exemption has been placed on the PRS Exemptions Register.

The UK Government has now published its White Paper CP337 - Powering our Net Zero Future setting out its energy strategy for the future. This strategy includes commitments to increase the Minimum Energy Efficiency Standard for non-domestic buildings in England to EPC Band B by 2030 and plans to increase the MEES for domestic properties to EPC Band C. Together with the better enforcement planned, this will make it increasingly difficult to rent lower performing properties without investing in improving their energy performance.

Frequently Asked Questions (FAQs)

Minimum Energy Efficiency Standards (MEES)

The simple answer – No.

The Energy Efficiency (Private Rented Property) (England and Wales) Regulations 2015 establish no specific exemption from MEES for Listed Buildings and other historical buildings. However, there is an exemption from making a specific improvement when third party consent if refused. This includes the situation where planning or Listed Building consent is refused. However, it is still necessary to follow the rest of the process to ascertain if any other improvements can be made.

Some people still mistakenly believe that Listed Buildings are exempt from EPCs automatically and therefore cannot fall within MEES. This is simply untrue as Listed Buildings are not automatically exempt from the need for an EPC and may require one like any other building. You can find out more about this in our FAQ “Do Listed Buildings need an Energy Performance Certificate (EPC)?“

Primary Sources

Secondary sources, evaluations & reviews

Domestic Minimum Energy Efficiency Standard (MEES)

Other considerations

If you are able to secure third-party funding to cover the full cost of improving your property to EPC E, you can use this and you don’t need to invest your own funding:

- the cost cap does not apply

- you should make use of all the funding you secure to get your property to band E, or if possible higher.

Funding can include:

- Energy Company Obligation (ECO)

- local authority grants

- Green Deal finance

Option 2: Combination of third-party funding and self-funding

If you can secure third-party funding but it is less than £3,500, and not enough to improve your property to EPC E you may need to top up with your own funds to the value of the cost cap.

Please note:

- you can count any energy efficiency investment made to your property since 1 October 2017 within the cost cap

- if your property can be improved to E for less than the cost cap, that is all you need to spend

If you are unable to secure any funding, you need to use your own funds to improve your property. You will never need to spend more than the cost cap.

You do not need to spend up to £3,500 if your property can be improved to EPC E for less. If you can improve your property to E for less than the cap, you will have met your obligation.

If it would cost more than £3,500 to improve your property to E, you should install all recommended measures that can be installed within that amount, then register an exemption on the PRS Exemption Register.

If you have made any energy efficiency improvements to your property since 1 October 2017, you can include the cost of those improvements within the £3,500 cost cap.

Information required for all exemptions:

Additional information required for each specific exemption:

Registering an exemption under the regulation 25(1)(b) exception – where a recommended measure is not a “relevant energy efficiency improvement” because the cost of purchasing and installing it cannot be wholly financed at no cost to the landlord (see Regulation 24(3)):

- This exemption is no longer available. The regulations have been updated to establish a cost cap representing the minimum investment that should be made on each property to try and bring it up to the MEES. To read more about this change click here.

Registering an exemption under the regulation 25(1)(a) exception – where all relevant improvements have been made and the property remains below an E:

- Details of any energy efficiency improvement recommended for the property in a relevant recommendation report (if separate to the relevant EPC), including a report prepared by a surveyor, or a Green Deal Advice Report;

- Details, including date of installation, of all recommended energy efficiency improvements which have been made at the property in compliance with the Regulations.

Registering an exemption under the regulation 25(1)(b) exception – where the property is below an E and there are no relevant improvements which can be made:

- A copy of the relevant report to demonstrate this (if separate to the relevant EPC).

Registering a wall insulation exemption under regulation 24(2):

- A copy of the written opinion of a relevant expert stating that the property cannot be improved to an EPC E rating because a recommended wall insulation measure would have a negative impact on the property (or the building of which it is a part).

Registering a consent exemption under regulation 31(1):

- A copy of any correspondence and/or relevant documentation demonstrating that consent for a relevant energy efficiency measure was required and sought, and that this consent was refused, or was granted subject to a condition that the landlord was not reasonably able to comply with.

Refusal of Tenant’s Consent: Where the party who withheld consent was a tenant, the exemption will only remain valid until that tenant’s tenancy ends. When that tenant leaves the property (or after five years, whichever is soonest) the landlord will need to try again to improve the EPC rating of the property, or register another exemption, if applicable. If a tenant leaves the property, the landlord is expected to complete any works necessary prior to reletting the property. As such, in these circumstances, a tenants refusal to consent cannot be used as an exemption for the new tenancy.

Refusal of Listed Building Consent: This is the correct exemption to register if Listed Building Consent is refused for making the relevant improvement. It must not be assumed that a Listed Building is exempt without first applying for consent.

Registering a devaluation exemption under regulation 32(1):

- A copy of the report prepared by an independent RICS surveyor that provides evidence that the installation of relevant measures would devalue the property by more than 5%.

Registering an exemption upon recently becoming a landlord (regulation 33(1) or (3)):

- The date on which they became the landlord for the property, and

- the circumstances under which they became the landlord.

Please Note: Where a person wishes to register an exemption upon recently becoming a landlord, the exemption will last for a period of six months.

Buildings and tenancies exempt from the regulations

Exemptions from making improvements

Other important considerations

The Energy Efficiency (Private Rental Property) (England and Wales) Regulations 2015 set out the penalties for non-compliance with the Minimum Energy Efficiency Standard (MEES). For domestic properties (flats, apartments, houses and other dwellings) they are:

- Letting a sub-standard property for less than three months when the penalty notice is served: A fine not exceeding £2,000 and publication of the penalty.

- Letting a sub-standard property for three months or more when the penalty notice is served: A fine not exceeding £4,000 and publication of the penalty.

- Registering false or misleading information in relation to an exemption: A fine not exceeding £1,000 and publication of the penalty.

- Failure to comply with a compliance notice: A fine not exceeding £2,000 and publication of the penalty.

Where a combination of offences have been committed by a landlord in relation to a single dwelling the fine is capped at a maximum of £5,000.

Non-Domestic Minimum Energy Efficiency Standard (MEES)

Buildings and tenancies exempt from the regulations

Exemptions from making improvements

Other important considerations

The Energy Efficiency (Private Rental Property) (England and Wales) Regulations 2015 set out the penalties for non-compliance with the Minimum Energy Efficiency Standard (MEES). For non-domestic properties (shops, offices, industrial & agricultural buildings and other non-dwellings) they are:

- Letting a sub-standard property for less than three months when the penalty notice is served: a fine not exceeding the greater of £5,000 or 10% of the rateable value up to a maximum of £50,000 and publication of the penalty.

- Letting a sub-standard property for three months or more when the penalty notice is served: a fine not exceeding the greater of £10,000 or 20% of the rateable value up to a maximum of £150,000 and publication of the penalty.

- Registering false or misleading information in relation to an exemption: a fine not exceeding £5,000 and publication of the penalty.

- Failure to comply with a compliance notice: a fine not exceeding £5,000 and publication of the penalty.